What are the changes to Research and Development (R&D) tax relief?

Businesses investing in innovation and developing new processes, products, or services can benefit from R&D tax relief. The R&D tax relief regimes, which came into effect in April 2023 and also expected in April 2024, may have a critical impact on your financial projections.

Changes from 8 August 2023, requiring companies to provide an Additional Information Form, which we look at below.

What is the purpose of changing the R&D tax relief regime?

By 2027, the government plans to increase R&D investment to 2.4% of UK GDP. The Government wants to make R&D tax relief more effective by increasing "additionality", the extra R&D expenditures that companies that claim the relief make. It does this by reducing the cost of innovation for UK companies. To combat errors and suspected abuse of R&D tax relief, the government is also introducing changes to the claims process.

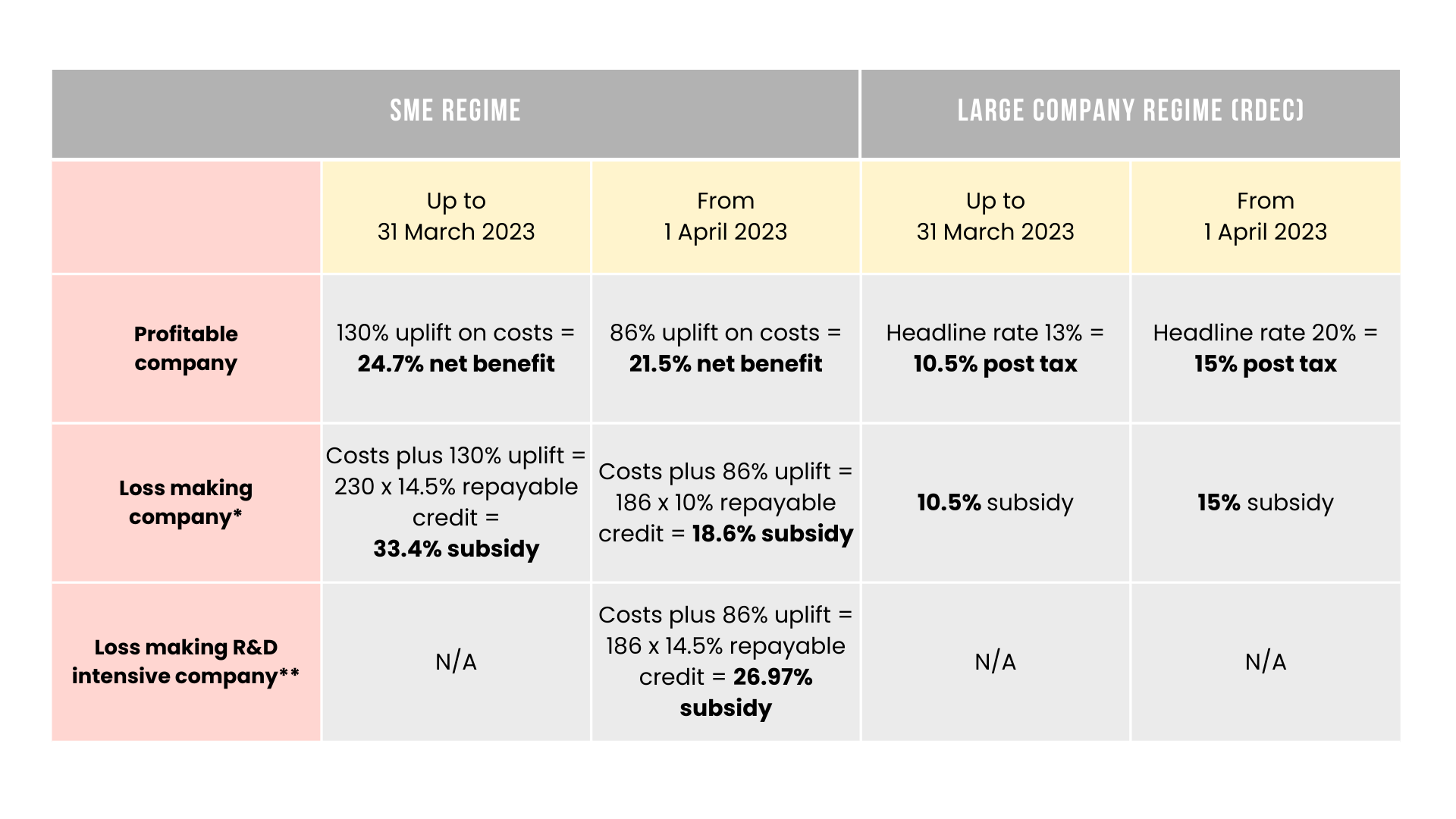

SME and RDEC rates are explained below. The Government has finalised proposals to combine the existing SME scheme and R&D Expenditure Credit (RDEC) rules into one unified program starting with costs incurred after 1 April 2024.

Tax relief rates for R&D from 1 April 2023

R&D tax relief rates for costs incurred from 1 April 2023 onwards were announced in the Autumn Statement:

**Loss-making R&D intensive companies are those that spend at least 40% on R&D. Using the total expenses in the profit and loss (P&L) account, the total expenditure will be calculated by adding any expenditure used under s1308 Corporation Tax Act (CTA) 2009 and removing any expenditure that is not deductible.

Both the SME and RDEC schemes cap repayable credit, although the cap is calculated differently.

Often, R&D costs can be claimed when they are incurred, but this is not always the case. Expenses covering a period of time, such as employee bonuses, must be apportioned based on accruals.

The correct rates of relief need to be applied to R&D costs if you don't have a year-end date of 31 March. When apportioning costs is challenging, HMRC may accept a blended rate of relief if it does not materially impact your claim.

R&D tax relief regime technical updates

There are also a number of technical and administrative changes coming, but these apply only to accounting periods that begin after 1 April 2023 and to costs incurred after that date.

-

Applicants for Advanced Assurance of R&D claims have been broadened by HMRC. SMEs can apply for Advance Assurance for R&D they are planning to do (or have already done) as long as they are not a member of a group and none of their related entities have previously applied.

The application process remains relatively straightforward with the submission of an online form. Before claiming R&D tax relief for accounting periods beginning on or after 1 April 2023, the company must complete a claim notification form to notify HMRC.

Companies seeking Advance Assurance will also be contacted by HMRC to arrange a telephone call to discuss the R&D in more detail. Normally, this is a short phone call, but more complex cases may require a longer conversation or a visit to the company.

To streamline the process and minimise the time required by the business seeking Advance Assurance, we recommend professional advice be sought before making the application.

-

The R&D expenditure categories will be expanded to include datasets and cloud computing costs. In some cases, however, you may not have to include non-technical personnel time in qualifying R&D projects if they are part of a "qualifying indirect activity".

Applicants will also be able to claim relief for pure mathematics R&D from accounting periods beginning on or after 1 April 2023 as part of their qualifying R&D activities. In the Guidelines on the definition of R&D, it is now stated that:

‘Mathematical techniques are frequently used in science. From April 2023 mathematical advances in themselves are treated as science for the purposes of these Guidelines, whether or not they are advances in representing the nature and behaviour of the physical and material universe’.

Perhaps this definition is more expansive than previously thought. In addition to exploring new mathematical concepts and examining the foundations of mathematics, new mathematical models, structures, and symmetries may also qualify.

-

Previously announced changes for accounting periods beginning after 1 April 2023 will now apply to costs incurred after 1 April 2024. It will be necessary to locate R&D activities in the UK in order to claim R&D tax relief. In the future, UK companies may no longer be able to claim R&D costs paid to overseas group companies or third parties. EPWs will only be charged for work carried out in the UK.

There will be specific exemptions where work outside the UK is permissible due to geographic, environmental, social, or regulatory/legal reasons. Among the examples given by HMRC in its draft legislation are deep ocean research and clinical trials, and by inference this would include medical-tech trials for specific patient groups, international telecommunications testing, or extreme environment testing.

Unless the work is being done overseas because of cost constraints or because the business does not have sufficient workers in the UK, companies will not be able to claim that overseas costs are exempt.

Example

123 Limited, an SME with an accounting year ending on 30 September, is engaged in multiple ongoing R&D projects. As part of its operations, the company outsources software development tasks to a third-party provider in China and incurs cloud computing expenses for running test routines on its evolving products and services.

To compile its R&D claim for the accounting year ending 30 September 2023, 123 Limited must perform various apportionments. These calculations include:

Software Development Costs Outsourced to China:

Claim relief for the period 1 October to 31 March on 65% of costs, with a 130% uplift.

Claim relief for the period 1 April to 30 September on 65% of costs, with an 86% uplift.

UK Direct Costs for the Project:

Claim 100% of the costs attributed to qualifying R&D activities.

Apportion these costs before and after 31 March to apply uplifts of 130% and 86%. Alternatively, if the costs remain consistent throughout the year, ABC Limited can negotiate with HMRC for a blended uplift rate of 108%.

However, 123 Limited cannot claim its cloud computing costs for the period from 1 April 2023 to 30 September 2023. In contrast, the company will be eligible to claim these costs for the year ending 30 September 2024. Nevertheless, it might face restrictions on its R&D relief, potentially being limited to RDEC rates under the new merged scheme. Additionally, 123 Limited may be barred from claiming overseas development costs for the period from 1 April 2024 to 30 September 2024.

-

It has been announced by HMRC that all claims must be made digitally, except for companies exempt from submitting a Company Tax Return online, and that additional information forms must be submitted separately from the main Corporate Tax Return via a new online portal.

All details must be entered on the Additional Information form for every R&D claim made on a tax return (even if you claim the same project for the second or later year) in HMRC's new guidance. It has even been confirmed that HMRC Customer Compliance Managers do not have the authority to eliminate the form for specific clients for which they already know the details.

The Additional Information form must be signed by a senior officer of the claimant company and contain detailed information about the R&D project, including the name of the agent who assisted the company with the claim. A breakdown of costs across categories must also be included in the form. Nevertheless, the form will not replace the R&D report that is currently submitted by good R&D advisors in most cases. In fact, HMRC recommends that large businesses submit an R&D report along with their R&D claim to explain the methodology and cost sampling techniques used.

HM Revenue & Customs has confirmed that if the 'Additional Information Form' is not completed, the R&D claim is invalid. HMRC can remove the R&D claim from the company's tax return where it believes it was made "in error".

-

Currently, the draft legislation requires companies to inform HMRC of their intention to file a claim between the start of the accounting period and six months after the end of the accounting period. Its purpose is to prevent speculative claims made after the relevant accounting year: it takes effect on or after 1 April 2023.

When the 'Advance Notification Form' is needed but not completed, HMRC will declare the R&D claim invalid, and if shown in the corporate tax return, it will be deleted as an "error".

The Advance Notification requirement does not apply to every single project during an accounting period, for example. Also, if you have claimed in the three years preceding the end of the claim notification period, you need not notify where claims are made within six months of the end of the accounting period.

Since R&D claims are usually made much later than 6 months after the accounting period (there is currently a 24-month deadline to make them), most companies will need to notify in advance - at least for financial year 2024.

During an Advance Notification, a company must submit a summary of its high-level planned activities, for example if you've developed software what it will be used for to demonstrate that the project meets the standard definition of R&D. There is no need to submit proof or documentation at that stage. The Advance Notification form is available here.

-

It will be possible to submit an amended claim within 30 days after HMRC challenges a RDEC claim or determines a tax assessment on RDEC against a company under new rules. As a result, making an error in a claim won't prevent you from making a corrected claim.

The company can still make a claim under the RDEC scheme even if an R&D claim is incorrectly submitted under the R&D SME scheme and HMRC rejects it. As a result, this is a very welcome development, since determining whether a company qualifies for SME status is often a complicated process.

Wrapping Up

The process of making an R&D tax claim can be complex, but our experts at Zyla Accountants are here to support you every step of the way.

To minimise the risk of your R&D tax relief claim being reviewed or challenged, along with all the associated costs and delays, there are simple steps you can follow.

Make sure you clearly define your case and how you arrived at the decision, completing all entries on the R&D section of the corporation tax return (CT600).

To support your R&D claim, make sure you submit a well-structured, technical report, with HMRC stating that "submitting additional information to support the claim, such as an R&D report, helps HMRC to process the claim faster.". Furthermore, this will make it clear to HMRC why the submission was made.

R&D tax specialists can be invaluable in guiding and supporting you through the process. There is a possibility that a penalty could be issued if an incorrect, inflated, or fraudulent claim is made. R&D tax specialists and consultants will ensure that your claims are accurate and submitted correctly.

As soon as possible, submit your R&D claim to mitigate any payment delays.

Check out some of our case studies here.