Financial Year Ends for UK Companies and Limited Liability Partnerships

In this article, Marian Riley from Zyla Accountants, shares some important advice for the Year End requirement and ways to prepare for it.

What is Year End?

In the UK it is a statutory requirement to report the financial position of the Company periodically to two organisations - Companies House and His Majesty’s Revenue & Customs (HMRC). It is normal for this to be an annual process and to occur at the end of the same month each year.

Purpose and responsibilities of Companies House

Companies House is a government body responsible for storing information about limited liability partnerships and companies. They also store a certain amount of information about Directors. They do not store information on sole traders or partnerships

Companies House has a responsibility to incorporate and dissolve companies

Companies House also have a responsibility to make certain information available to the public - primarily through their website:

https://find-and-update.company-information.service.gov.uk

Purpose and responsibilities of HMRC

HMRC is a government body responsible for collecting the money required to pay for UK public services and for distributing funds to individuals and families that need financial support

HMRC and Companies House do share information although the submissions are done separately.

Company responsibilities in relation to Companies House

Only the first of these relates to the financial year end but are added here for completeness

to file accounts in a statutory format for each accounting period within the required period of time

to file a confirmation statement annually

to file other information such as a change of directors, issue or change in share capital or when a charge (or mortgage) is taken out on any of the assets.

Deadline for filing statutory accounts - 9 months after the end of the accounting period (or 1 year and 9 months after the date of incorporation if that is earlier)

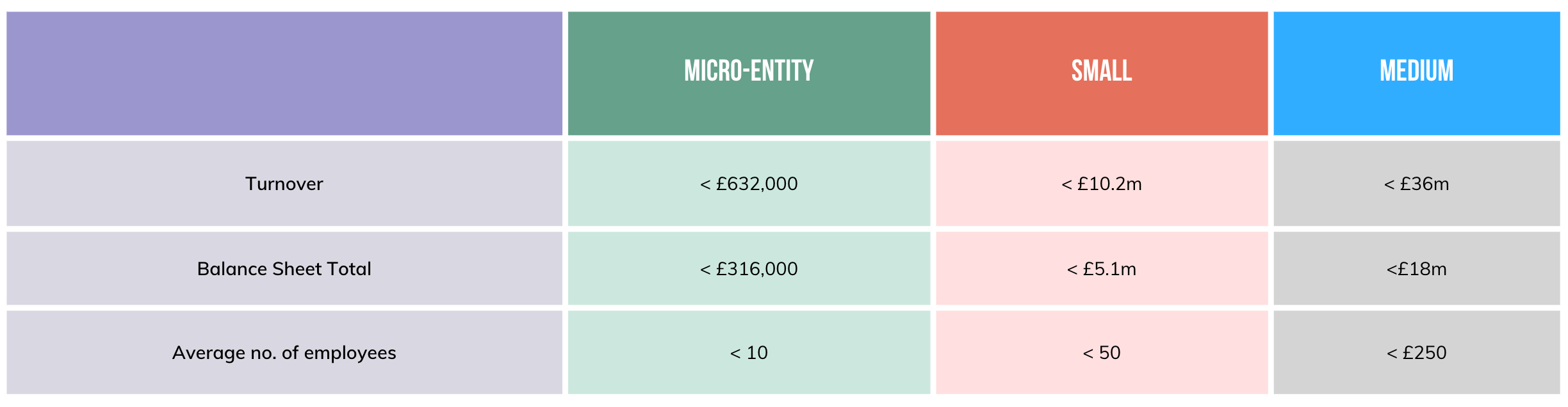

The disclosure requirements of statutory format accounts will vary depending upon the size of the company - see the table below. The larger the company the more it is required to report and disclose.

You have to meet 2 of the 3 thresholds for two consecutive years to qualify. Any companies that do not meet the criteria for micro-entities, small or medium are large companies.

Company responsibilities in relation to HMRC

HMRC requires more detail than the statutory accounts filed at Companies House so it is a requirement to fill out a self assessed corporation tax return within certain deadlines

Deadline for payment - payment of the assessed corporation tax has to be made within 9 months and 1 day of the end of the tax return period (usually the same date as the accounting period). In the first year of a Company’s life it is important to be alert to deadlines as they may differ from the accounting date.

Deadline for filing return - Filing of the corporation tax return is due 12 months after the accounting period end date - although practically it is done earlier so that you know how much needs to be paid!

Ways to prepare for Year End

Bookkeeping - ensure that all entries for the year are posted through Dext and bank accounts are reconciled on the Xero Dashboard

Obtain copy statements for bank accounts, loans etc. Errors do occasionally occur in the live bank feeds so it is important to double check against the Banks own records

Review fixed assets and other investments - do you still have all of the assets listed on your fixed asset register? If the value of assets or investments have decreased then that should be taken into account

Stock take - if you have a stock of goods for sale, then this is a great opportunity to count that stock to ensure what you have in the books is representative of what you have in the warehouse

Review of debtors/creditors and other commitments - similarly, it is a good time to review all debtors and creditors to make sure that the numbers in the books are a fair picture of what is owed or owing. It is also important to consider financial commitments that have been made before or after the year end that ought to be reflected in the books to show a fair financial position for the Company

At least annually there should be an honest discussion within the Company about whether or not the business is viable or a going concern. It is a serious matter for Company Directors to trade whilst knowingly insolvent. Directors can be held personally liable for the debts of the business and possibly be disbarred from holding future directorships

Tax questions - It would be useful to consider whether certain entertainment, fines, depreciation and capital allowances need to be taken into account. We can help you with those questions whilst we are preparing the year end reports.