An update from HMRC on fuel rates

For company car drivers claiming back fuel costs, HMRC has published new Advisory Fuel Rates (AFRs) effective Wednesday (March 1 2023).

Drivers of electric company cars will be reimbursed 1 pence per mile (ppm) more under the new rates.

From December 1, when it last reviewed its mileage rates, HMRC increased the (AER) from 5ppm to 8ppm.

The way the AER is calculated by HMRC has been changed since then in order to better reflect prices.

In the past, many companies had only used the annual figure published by the Department for Business, Energy & Industrial Strategy (BEIS) to reimburse electric company car drivers for business mileage, and the electrical energy consumption values provided by the Department for Transport (DfT) for each model of car.

In its quarterly AER review, HMRC continues to use the BEIS and DfT data, but it also incorporates figures from the Office for National Statistics (ONS) quarterly index for domestic electricity, which is part of the Consumer Price Index.

Fuel prices have fallen since March 1, resulting in lower AERs for petrol, diesel, and LPG.

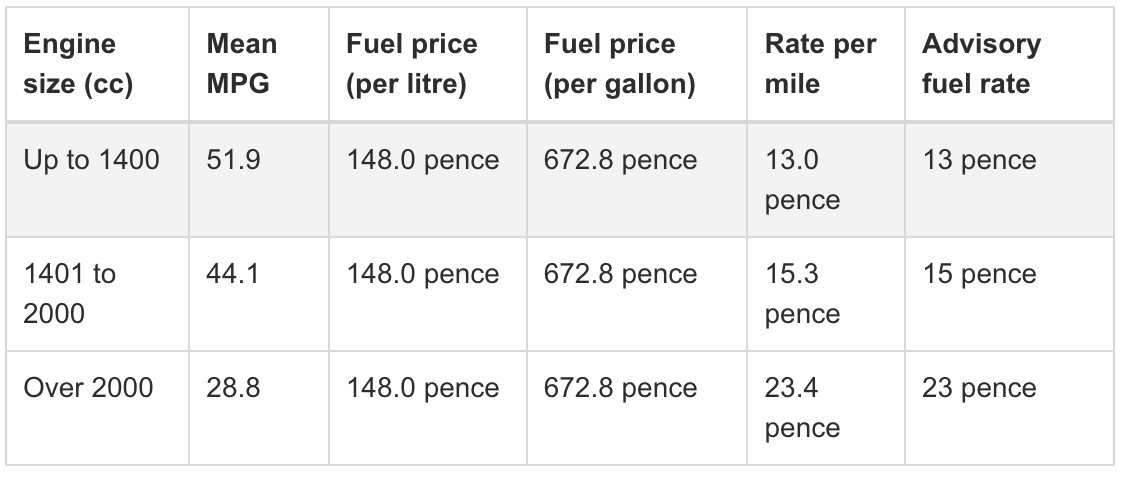

The AFR for petrol vehicles up to 1,400cc has been cut from 14p per mile (ppm) to 13p per mile (ppm). From 17 to 15 ppm, petrol vehicles sized 1,401-2,000cc see a decrease of 2 ppm.

This decrease is the largest for vehicles with engines over 2,000cc, which has been reduced by 3ppm from 26-23ppm.

Diesel vehicle reimbursement rates have also been reduced by HMRC. From 22-20 ppm, the diesel rate for company cars with more than 2,000cc remains reduced by 2 ppm; the AFR for diesels with a motor of 1,600cc is reduced by 1 ppm, from 14-13 ppm, and the AFR for diesels with an engine of 1,601-2,000cc is reduced by 2 ppm, from 17-15 ppm.

LPG vehicles up to 1,400cc continue to be regulated at 10ppm, but those with engines 1,401-2,000cc have been cut by 1ppm from 12-11ppm. A 1ppm reduction will also be made to LPG vehicles with engines exceeding 2,000cc, from 18-17ppm.

For AFR purposes, hybrid cars are either classified as petrol or diesel cars.

Diesel AFR methodology

Petrol AFR methodology

LPG AFR methodology