A guide to THE 2025 merged R&D scheme

R&D tax relief in the UK has undergone a major overhaul.

There is now one merged R&D scheme for small and large companies instead of two separate schemes. In the accounting period beginning after 1 April 2024, everyone planning to claim R&D Tax Credits will be affected by the change.

There are several important changes in R&D tax relief for profit-making SMEs and large businesses that businesses should keep in mind. For example, R&D tax relief rates have changed so that they are similar to those in the previous RDEC scheme.

This article from Zyla Accountants explains everything you need to know about claiming under the merged R&D scheme.

How does the merged R&D scheme work?

R&D expenditure credits (RDECs) are rewards for innovative businesses that carry out R&D projects that seek to advance science or technology (including mathematical advances).

Improvements to existing products or services or inventions are examples of this. Science and technology advances can also lead to a new discovery that improves our understanding of a field.

A project must deal with an uncertainty that a competent professional might not be able to resolve on their own. It means proving that a solution wasn't obvious and that systematic experimentation was required to overcome challenges.

Businesses can claim a tax credit for expenses related to R&D such as staff remuneration, consumables, software, data licenses, and cloud computing. If you are interested in finding out what qualifies as R&D expenditure, please read our article.

What is the expected start date for the merged R&D scheme?

From 1 April 2024 onwards, the merged R&D scheme will apply. Due to this, companies will begin utilizing the scheme at different times depending on their tax year.

Companies with a year-end of 31 March 2024 will use the new scheme for their accounting periods ending 31 March 2025. As of 31 December 2025, accounting periods ending 31 December 2024 will first be subject to the new scheme.

Which rates apply to the merged R&D scheme?

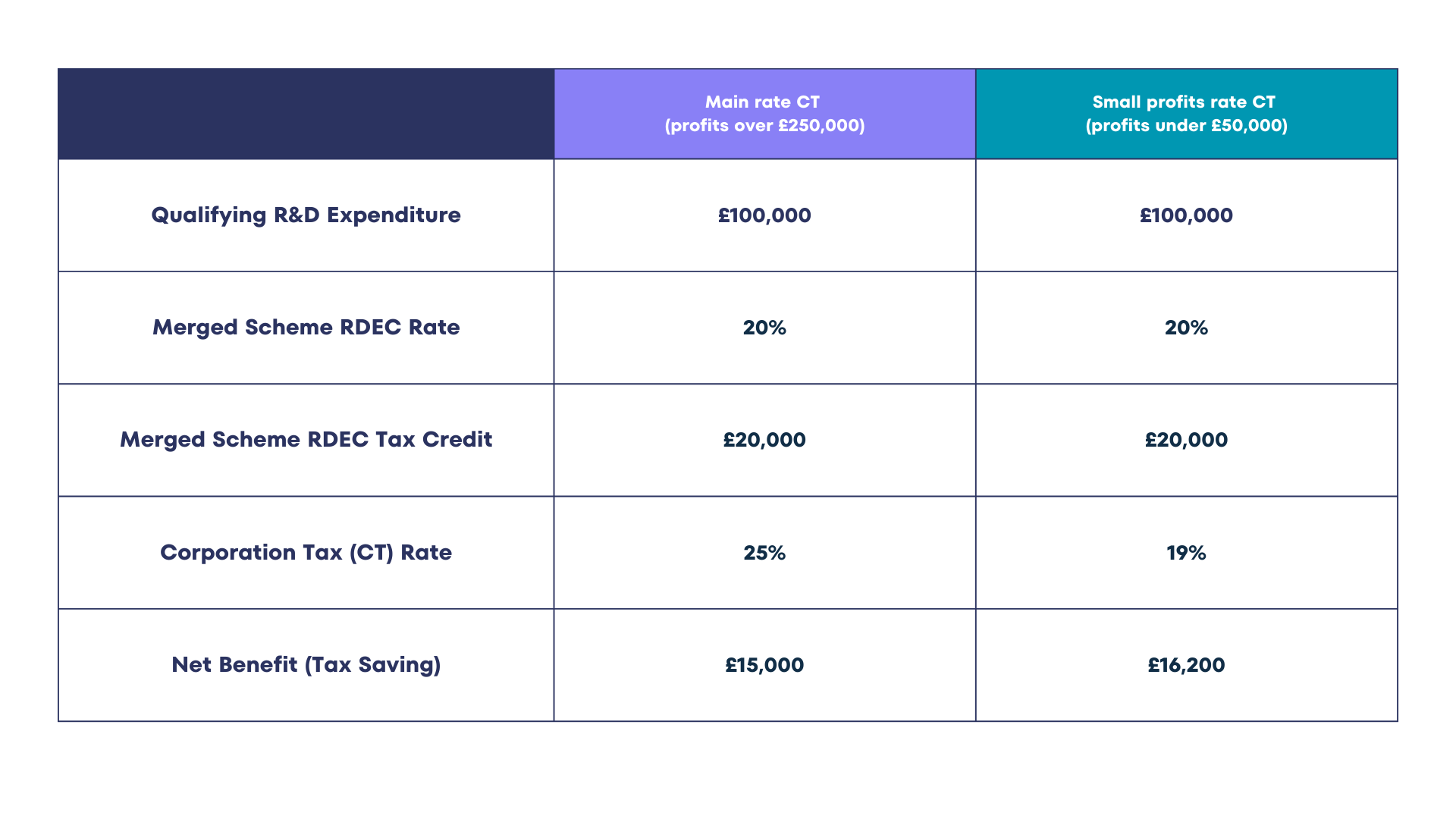

SMEs and large companies can claim a 20% credit on qualifying R&D expenditure, which is taxable as trading income under the merged R&D scheme.

Depending on the qualifying expenditures and corporation tax rate, a company's final benefit will vary. Below are examples of how benefits are calculated:

The support for loss-making SMEs engaged in R&D

SMEs that are losing money while investing in R&D are also offered enhanced intensive support (ERIS). In accounting periods beginning from 1 April 2024, SMEs with a high R&D intensity are those whose research and development expenditures are 30% or more.

In addition to the non-taxable credit of up to 14.5%, qualifying SMEs can deduct an additional amount for qualifying R&D expenses.

During temporary dips in R&D intensity, companies are offered a one-year grace period to avoid losing tax relief on R&D. Companies can still claim benefits if they meet the R&D intensity threshold in one year but fall short the following year.

For the same project expenditure, eligible R&D intensive SMEs can claim under both R&D schemes if they prefer.

Does the merged R&D scheme compare with the previous RDEC and SME schemes?

In comparison to the previous RDEC scheme, the new merged scheme has some key differences.

Regulations for subcontracted research and development

There are new rules for subcontracted research and development. Tax relief can now only be claimed by the company that commissioned the R&D (i.e., not the contractor).

However, subcontractors can still claim relief in certain situations, such as for in-house R&D that isn't related to a customer contract, or if the customer cannot claim (e.g. if the customer fails to pay UK corporation tax).

R&D spending restrictions overseas

For accounting periods starting from 1 April 2024, there will be a new ban on claiming overseas R&D costs, with some specific exceptions, in order to benefit (and stimulate) UK-based innovation.

Even if the R&D cannot be done in the UK or replicating the required conditions would be unreasonable (because it is too costly or impractical for whatever reason), it is still possible to claim R&D relief for work done outside the UK. The article on qualifying overseas expenditure (QOE) explains more.

Streamlining rules for subsidised expenditures

Either the merged scheme or ERIS may now provide relief for companies with subsidised or grant-funded R&D projects.

Work restrictions for externally provided workers (EPW)

R&D relief will only be available to UK workers paid through a PAYE scheme if they are externally provided workers (EPWs).

The list of qualifying bodies has been removed

The new merged R&D scheme removes the limit on which companies can contract out research under the previous RDEC scheme, which was deemed too complex by the government.

Caps on PAYE and NICs adopted under the SME scheme

As a result of the merger, the PAYE and National Insurance Contributions (NIC) caps are more generous than those in the SME scheme. The cap will therefore be higher, resulting in fewer companies exceeding it.

In addition to 300% of the business's relevant PAYE and NIC liabilities, the PAYE cap includes £20,000 as well. Excess R&D Tax Credits can be carried forward to the following accounting period as a credit if they exceed this cap.

How did the merged R&D scheme come about?

Efforts are being made by the government to ensure that R&D tax relief supports genuine, impactful research and development that contributes to the growth of the UK economy.

In spite of efforts to curb abuse of R&D Tax Credits, there has always been a high rate of errors and fraud in the SME program. RDEC was also considered more effective, as HMRC reviews have shown that it has generated more private R&D investment per pound of government spending.

Furthermore, there has been a stated goal of "tax simplification" with a single relief scheme - although this hasn't been achieved since both schemes (ERIS and combined R&D) remain.

Claims for merged R&D schemes

The company must prepare a detailed technical report outlining how R&D projects meet HMRC's strict criteria in order to claim R&D Tax Credits.

It is always a good idea to document all R&D-related activities and plans. No matter how successful or unsuccessful a project has been, it's best practice to keep records. Records may include project plans, technical documents, meeting minutes, and receipts for consumable materials.

Contact Suzy Kerton CA at Zyla Accountants for support with your R&D claim today. View our case studies here.